One of the questions I see often when it comes to travelling as a family is: Should I buy travel insurance?

When scrolling through comments on a few Facebook Travel groups, I was shocked to learn that many travellers don’t purchase travel insurance for their families. Personally, I couldn’t step foot outside my province of residence in Canada without travel insurance.

And here I am, writing this article after recovering from strep throat while on vacation with my family in San Diego. Almost every time we travel as a family, someone gets sick, a bag gets lost in one of the airports, or a flight gets cancelled.

It’s why we NEVER travel without full travel insurance. And you should NOT, as well.

✔️ Even if you’re leaving only for a weekend.

✔️ Even if you are covered by your province’s health system.

✔️ Even if you are never sick.

So, in this article, I’m telling you:

- Why you should always get travel insurance when travelling

- Why InsureMyTrip is a great tool to help you find the best travel insurance for your needs

💡Disclaimer: I have travelled extensively and used different travel insurance companies. However, all my experiences are from a Canadian perspective. Some particularities may vary if you are from another country.

For US travellers, this article by Nomadic Matt may be useful. Also, all the information in this article is based on my own understanding, research, and experience. If you have any special and individual needs, you should contact InsureMyTrip directly.

Disclaimer: Just a heads up, this free article contains affiliate links. If you purchase after clicking one of these links, I may earn a small commission at no additional cost. Also, as an Amazon Associate, I earn from qualifying purchases. Your support helps me continue to provide helpful and free content for you.

Do You Need Travel Insurance?

Yes! You should always consider purchasing travel insurance.

💡 Did you know that even when travelling to another province in Canada, Canadian citizens should get travel insurance to cover all medical costs in case of an accident or health problem? Because not all provinces have the same medical costs.

Different Types of Travel Insurance & Which One to Choose?

Travel insurance includes several aspects, and it’s much more than just health insurance. Many Canadians already know they should have medical travel insurance when travelling outside Canada, but there are a few other options.

1. Health or Medical Travel Insurance in Canada and Outside Canada

Health (or Medical) travel insurance is the most common and most well-known type of travel insurance for Canadians.

Medical travel insurance will fill the gaps between your provincial health insurance coverage while travelling interprovincially and internationally.

The way travel insurance coverage is set up is that:

- The standard provincial health care insurer takes charge of the medical care at the same rate/cost as if you received the medical care in your home province.

- the travel insurance provider then covers the additional cost of the care.

That’s why it’s super important to have travel medical insurance when travelling to a country where the cost of medical care is higher than in Canada, for example, the United States.

The travel insurer can sometimes work directly with hospitals to bill for major emergencies or long hospitalizations. They also manage the part from the other insurer, which facilitates paperwork on your side.

💡 It’s important to know that most travel insurance providers will cover you if you are still insured through your standard provincial health care insurer.

2. Trip Cancellation Travel Insurance

Trip cancellation travel insurance will cover all the costs you already paid if your trip was to be cancelled.

There are a few reasons why you might need to cancel your trip, such as if you (or a person on your travelling party) get sick and can’t travel. But there can also be other external reasons.

For example, in 2019, we were supposed to go to Sweden for a few weeks. We booked with the Ultra Low-Cost WOW Airline, with a layover in Iceland. We had paid for our flights and reserved all our Airbnbs (with one with a strict cancellation policy).

A few months before our trip, the airline went bankrupt, and we lost everything. It’s a good thing we had good trip cancellation travel insurance.

We got the money from our flights back and the portion of the Airbnb that wasn’t reimbursed after the cancellation. Sadly, the last-minute cost of flights for a family of 4 was way too expensive. We had to cancel our entire trip, but we didn’t lose any money.

Trip Interruption Travel Insurance

Trip interruption travel insurance will cover you if you need to cut short a trip (while travelling) for a covered reason indicated in your policy and must return home. It can reimburse you for the prepaid, nonrefundable, and non-transferable unused portion of your trip—for example, flights, accommodations, event tickets, excursion expenses, etc.

It can also reimburse you for additional transportation expenses to return home to Canada.

Finding the travel insurance coverage your family needs with InsureMyTrip.

Having travel insurance is one of those travel essentials. Without insurance, you may be paying high fees and unexpected costs, which might ruin your trip and your savings account.

Nothing is worse than having a great time on your holiday and then dealing with an unexpected hospital visit or medication you need to buy abroad.

There are so many types of travel insurance to choose from it can be overwhelming to pick one.

It’s why we love InsureMyTrip.

InsureMyTrip is a travel insurance comparison website that will help you find the right travel insurance providers and policies that fit your travel plans.

You can easily get a quote and compare plans from top Canadian insurance providers. InsureMyTrip lets you choose the policy that fits your needs. Their licensed representatives offer unbiased advice and only recommend plans based on real customer feedback.

It’s important to note that InsureMyTrip does offer provider plans featured on its website to help you find the best one for you and your trip. It will support you every step of the way, from the moment you begin a quote to your post-trip return.

However, InsureMyTrip does not handle claims but will assist you with the claims process should you need to file one with your provider.

With InsureMyTrip, you can compare different insurance providers and policies in one place. It also allows you to find all-inclusive travel insurance policies covering medical expenses, trip cancellations, lost baggage, car rental insurance, and more.

InsureMyTrip has been helping travellers find travel insurers in the United States since 2000 and in Canada for the past three years.

InsureMyTrip: The Pros and the Cons

✅ All options and providers are found in the same place.

✅ You can directly receive a quote online and purchase online through the InsureMytrip portal.

✅ There is a full team of travel licensed professionals to help you in the process of getting your travel insurance. They can also assist you if you need support after filing a claim as a claim advocate.

✅ You can find medical insurance, trip cancellation, trip interruption, and other travel insurance, such as car rental coverage.

✅ There are no additional fees to purchasing through InsurreMyTrip. It’s the same price as booking directly through the travel insurance provider, but it’s a huge time saver.

❌ There are only a handful of providers in Canada at the moment.

❌ You need to have fixed travel dates.

How Much Is Travel Insurance in Canada: Filling a quote with InsureMyTrip

The cost of travel insurance varies a lot depending on a few different factors. The final cost of your travel insurance will depend on:

- total trip cost,

- travellers ages,

- number of travellers,

- level of coverage (medical only, trip cancellation, all-inclusive coverage)

- destination if high-risk or remote,

- limits, deductible and

- add on options :

Here is an example of a quote for a 2-week trip to Iceland for our family (two adults and two children living in Alberta):

Step 1: Province of Residence

One of the first questions asked is about your province of residence since all provinces work differently regarding health insurance.

Also, it’s important to know that insurance is currently unavailable to New Brunswick and Quebec residents.

Step 2: Trip Information

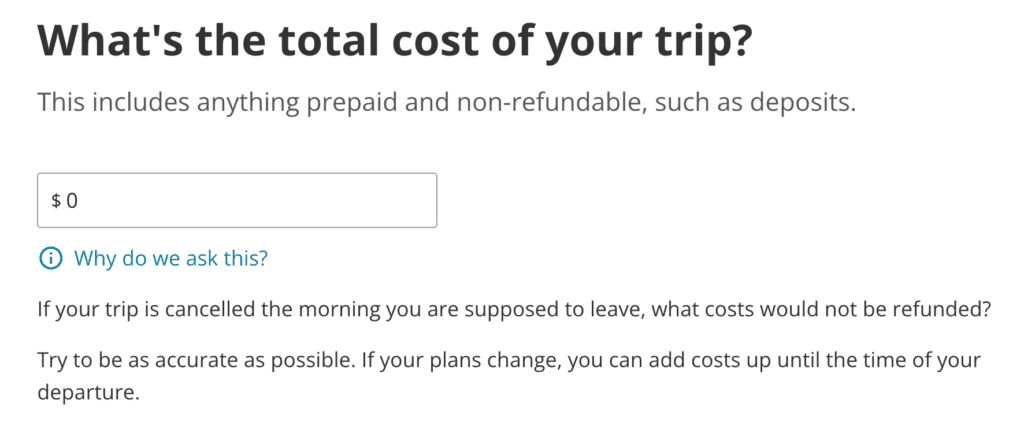

You’ll then need to enter information about your trip dates, who will be travelling with you, and the total cost of your trip.

It can be hard to estimate the total cost of a trip, especially in the early stage of planning, but think about this:

If your trip is cancelled the morning you are supposed to leave, what costs would not be refunded?

So, you’ll want to include:

- Cost of your flights

- Cost of your car rental

- Cost of your lodging

For this test quote, I added $10000, which included our airfare (we ended up needing to use our travel insurance before the Calgary to Toronto leg of our initial flight with Lynx Air, which went under a month before our trip), campervan rental, and a little extra.

Step 4: See what’s available

And that’s it. You are then ready to see what is available for you.

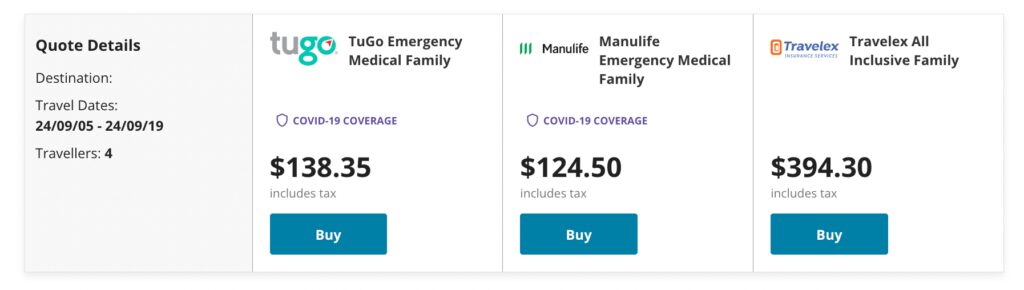

Here is a recap of this quote:

- Travelling to Iceland

- 2 week trip

- 4 travellers (2 adults and 2 children)

- Cost of travel: $10,000

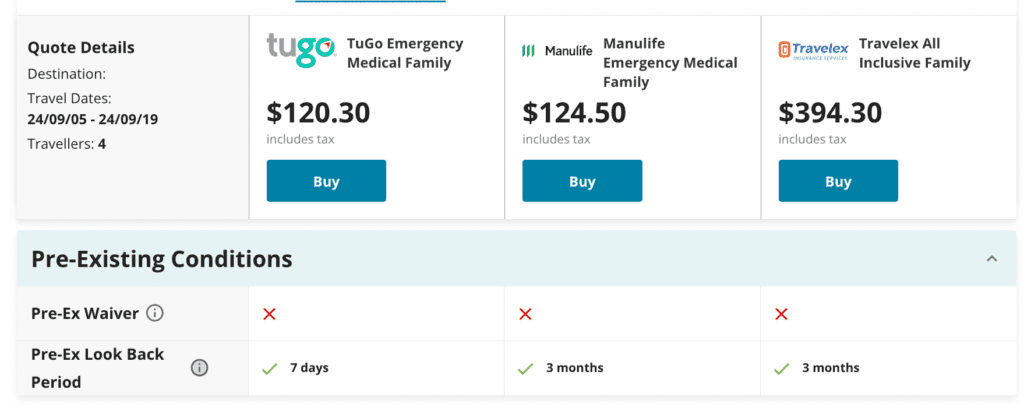

As you can see, the cost varies greatly depending on the provider.

You can compare up to 3 different plans to help you decide depending on your needs. You’ll see, for example, what is included:

- Medical coverage

- Trip cancellation

- pre-existing conditions

- Baggage lost coverage

- Car rental insurance

- And so much more.

What to Know Before Purchasing a Travel Insurance

If you’re ready to purchase travel insurance, here are a few important things to remember.

1. Pre-existing Condition

One good thing about travel health insurance is that the premium won’t change whether you had a previous claim or not on other trips. But, many travel health insurers won’t cover any pre-existing conditions.

When purchasing travel insurance, you may be asked to declare all known health issues and all medical problems you had before your trip departure date. And those medical problems will likely not be covered by your travel insurance.

What is a pre-existing condition?

A pre-existing condition is any change in your health documented in your medical record by a medical professional, including any treatments, diagnostic tests or examinations, medical recommendations for tests or examinations, or a change in prescribed medication.

Some examples of pre-existing conditions include:

- Diabetes

- Asthma

- High cholesterol

- Long-term back conditions

- Coronary heart disease

- Cancer

- Hypertension

- Autoimmune diseases such as Crohn’s, lupus, multiple sclerosis, and rheumatoid arthritis

- Pregnancy before enrollment

What does that mean?

Here is a simple example: When my youngest son was a baby, he had multiple ear infections, one of which was only a few weeks before a trip. We went to the doctor, got some antibiotics, and decided to travel anyway. If, for a particular reason, he had another ear infection while abroad, the travel insurance might not have covered any cost related to this ear infection.

But if you have the same sickness during a long-term trip (but didn’t have it 90 days before departure), you would be covered for it.

Looking at the comparison chart from InsureMyTrip, we see, for example, that TuGo’s Pre-Existing Look-Back Period is only 7 days. TuGo can only look back into medical records of the past 7 days to determine if it is related to an excluded pre-existing condition. The other two providers can look back up to three months.

2. Country of Travel

There are many things to look out for before purchasing medical travel insurance, but one of the most important is to check which countries your policy applies to.

For example, InsureMyTrip doesn’t offer policies for travellers to or from Cuba, Iran, or North Korea.

Another thing to consider before purchasing travel insurance is the advice from your government.

Most travel insurers won’t cover you for any travel where the government has issued an “Avoid all travel” advisory.

For example, most Canadian travel insurers will not cover travellers going to Afghanistan as the Canadian Government has issued an advisory of “Avoid all travel”. The same goes for Iran, Burundi, Chad, and others.

Note: If the government advisory changes while travelling, you should be covered, as long as it wasn’t an “avoid all travel” advisory before departure.

Also, the insurance cost may vary depending on where you’re travelling.

3. Provincial Health Care Insurance

Most travel insurance may cover you if you are still insured through your standard health care insurer. The way insurance coverage is set up is that the standard health care insurer takes charge of the medical care at the same rate/cost as if you got the medical care in your home country.

The travel insurance then covers the additional cost of the care. That’s why it’s super important to have travel medical insurance when travelling to a country where the cost of medical care is higher than in your home country.

Note for all Canadian travellers: You keep your provincial health coverage if you are outside the country for less than 183 calendar days (trips outside the country of less than 21 days are not calculated). That means that you can leave the country for 6 months per year, for a total of 12 months, if your trip starts in July and you come back before the end of June of the following year.

4. All the Fine Print

If there is one contract you should entirely read, even all the fine print, it’s your contract when purchasing travel insurance. Those fine print may change everything.

You want to know exactly what is included in your insurance and what is excluded. For example, most insurance won’t cover medical care resulting from high-risk activities, such as diving, rock climbing, and paragliding, …

Also, as mentioned earlier in this article, some pre-existing conditions may or may not be covered. All of this will be written in the contract.

Final Thoughts

When travelling with (and without) your family, you should always consider purchasing travel insurance, whether medical or trip cancellation.

We don’t like to think things can go wrong, but they can. A big illness doesn’t have to ruin your trip and your budget.

We’ve travelled a lot with our kids in the past years, and there is almost always a little something on each trip that requires us to call our insurance, from a baggage loss to a small sickness, we would have lost SO MUCH money if we didn’t have travel insurance.

Using InsureMyTrip, a travel insurance comparison website, will help you find coverage that fits your needs and save time and money.

Do you purchase travel insurance when travelling?